"Brother, Can You Spare a Dime?" Revisited

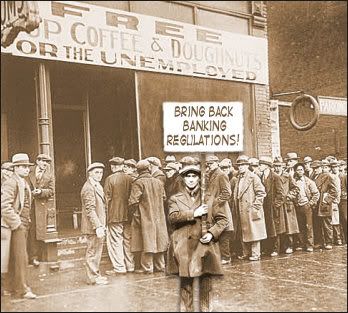

In late 1999, the bulwark bank regulation of 1933, the Glass-Steagall Act -- the wall between investment banks and commercial banks -- was torn down. This was a great victory for creative bankers, who had found the wall irksome and restrictive.

However, this teardown reduced the stability of the financial system and opened the way for the Bankers Panic of 2008. Senator Carter Glass, who led in the creation of the Federal Reserve System in 1913, saw how the deposits of correspondent banks flowed to New York City where the big banks were tempted to speculate with the funds. He was determined to keep the investment-banking foxes out of the commercial-banking chicken coop. A wall was created around the banking system to separate investment banks and their assets from commercial banks.

When this wall came down in 1999 with the Financial Modernization (Gramm-Leach-Bliley) Act, it allowed banks and investment banks to join up through the bank holding company mechanism that had been created in 1956 with a cautious requirement that the Federal Reserve approve creation of a bank holding company. No bank holding company headquartered in one state could acquire a bank in another state. It generally prohibited a bank holding company from engaging in non-banking activities or acquiring voting securities of certain companies that are not banks. [...] (Read the rest at Huffington Post)

However, this teardown reduced the stability of the financial system and opened the way for the Bankers Panic of 2008. Senator Carter Glass, who led in the creation of the Federal Reserve System in 1913, saw how the deposits of correspondent banks flowed to New York City where the big banks were tempted to speculate with the funds. He was determined to keep the investment-banking foxes out of the commercial-banking chicken coop. A wall was created around the banking system to separate investment banks and their assets from commercial banks.

When this wall came down in 1999 with the Financial Modernization (Gramm-Leach-Bliley) Act, it allowed banks and investment banks to join up through the bank holding company mechanism that had been created in 1956 with a cautious requirement that the Federal Reserve approve creation of a bank holding company. No bank holding company headquartered in one state could acquire a bank in another state. It generally prohibited a bank holding company from engaging in non-banking activities or acquiring voting securities of certain companies that are not banks. [...] (Read the rest at Huffington Post)

The US is undergoing a financial earthquake. Its commercial banks and mortgage companies have lent heavily to borrowers -- something that prudent banks with proper risk management systems are not supposed to do. Its “efficient” investment banks readily securitized the loans and sold them to investors, keeping a significant chunk on their balance sheets. Its investors along with European investors and banks willingly invested in these securities.

How could the bank supervision system in one of the world’s most developed countries mess it up so badly?

Part of the answer lies in the fragmented American supervision system of banks and bank-like intermediaries (credit unions, saving associations, etc.) between agencies like the Fed, the Office of the Comptroller of the Currency and the Office of Thrift Supervision. Further is the schism between state and federal supervision -- the difference between state-chartered banks versus federal banks, etc. All this is an inheritance from the peculiarities of US history (still currently evolving), and I believe that it is quite relevant. But that is not the whole story.

More important than this fragmentation are three other important external factors that drove the failure of US bank supervision system... [...] (Read the rest at Today's Zaman)

How could the bank supervision system in one of the world’s most developed countries mess it up so badly?

Part of the answer lies in the fragmented American supervision system of banks and bank-like intermediaries (credit unions, saving associations, etc.) between agencies like the Fed, the Office of the Comptroller of the Currency and the Office of Thrift Supervision. Further is the schism between state and federal supervision -- the difference between state-chartered banks versus federal banks, etc. All this is an inheritance from the peculiarities of US history (still currently evolving), and I believe that it is quite relevant. But that is not the whole story.

More important than this fragmentation are three other important external factors that drove the failure of US bank supervision system... [...] (Read the rest at Today's Zaman)

9 Comments:

I can understand why they thought everything would be fine, given how well the Savings and Loan thing turned out.

I find it shocking that big business would try to get out of being regulated, shocked I tell you!

Heck giving how many of the political players were connected to folks in the S&L scandal - it just seems the learning curve for these folks is impossibly steep.

Perhaps they need a tutor to guide them back to factual/historical reality?

How about this- maybe it is just the forces of good old fashioned All-American mothahfreakin greed at work?

well duh, where is the risk? if every time you mess up the American taxpayer is there to bail your ass out? Ask the Bush's, they know!

It seems that America as a nation is rabidly intent on destroying every shred of what made us good and strong in the centuries prior to the 21st.

We are getting closer to the moment when America is no longer recognizable to those of us who grew up in the 20th century. And so it goes...

Oh come on, breadlines are romantic, kind of like serving on the front overseas!

an economist buddy of mine warned me about this 4 years ago and said it was really going to happen although he didn't know when.

Übermilf: Yeah, those were the days!

Dr. Monkerstein: Indeed! "Here are your winnings, Captain Renault."

MWB's World: Germaine Gregarious will teach them! She has a very persuasive way about her.

FranIAm: No doubt this is true - the old "invisible hand of the marketplace" strikes again.

Liberality: Republicans hate socialism, unless you're talking about bailing out their corprate cronies. Then they love socialism!

Dave The Angry Rhode Islander: That is actually very sad and true. I can't make about that.

Randal Graves: I think that the food was pretty bad in both situations.

Swinebread: I wish that he had warned a few more people. :o(

Post a Comment

<< Home