The Flat Tax Myth

The concept of a flat tax bears some explanation. There are three main types of taxes: the progressive tax, the regressive tax, and the proportional tax. a progressive tax taxes the wealthy more than the poor, a regressive tax taxes the poor more than the wealthy, and a proportional tax uses the same percentage across the board regardless of income.

Many of the taxes you pay today are flat taxes. When you get a drivers license or library card, you pay the same as everybody else. Sales tax is a flat tax.

The idea of a flat tax for federal and state income tax appeals to many conservatives. Almost every year in congress bills are introduced that directly relate to the concept of a flat tax. Steve Forbes ran for president in 1996 on a platform of a 17% flat tax.

In talking about the flat tax it is important to note that there is difference between the flat tax in theory and in the real world. When assessing the validity of any proposed flat tax one must think about the context within which it is being applied, as well as how the author is defining the term "flat tax." With a flat tax, all taxpayers would pay the same rate.

Under a flat tax system for federal and state taxes, paperwork would be largely eliminated as taxes could be filled out on a single sheet of paper, but that there would also be a huge public outcry if the government don't have deductions for charitable contributions, mortgages interest, real estate taxes, etc.

Remember that once you allow anything like deductions for real estate or child support then it is not a flat tax anymore. for example, students that have to pay interest on their tuition loans get a tax credit. If that were removed, students would lose that incentive. But if you left it in, then it would no longer be a flat tax. This would affect many areas, including charities and the disabled.

The popular conception of a flat tax is that it would lower taxes for the wealthiest and raise taxes for the poorest - unless you lowered all taxes to the lowest level, but this would (of course) generate insufficent revenue for the state and federal government.

If the United States were to adopt a proportional tax system, that is to say a tax rate that averages the rates paid by the upper and lower classes, the tax rates for those with lower and higher incomes would have to change in proportion to generate the same income.

Our present tax system is by definition largely progressive, which means that how much you pay in taxes is based on how much you earn.

For example, the average federal tax rate for the bottom 50% of taxpayers in 2003 was 2.95%, while the average federal tax rate for the top 50% of taxpayers was 13.35%.

in a proportional tax system, the tax rate for the top 50% would go down, and the average federal tax rate for the bottom 50% of taxpayers would go up. If the tax rate for the lower percentage of taxpayers goes up, this would give them less available income to spend. The top 50% would have a larger percentage of their available income to spend.

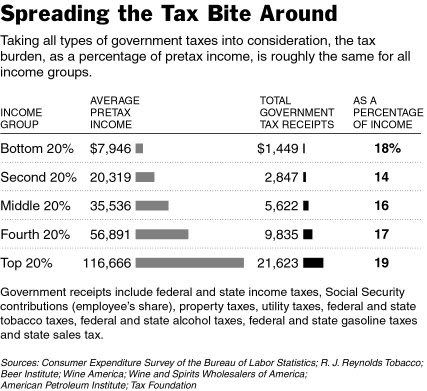

The subject is actually far more complex than the scope of this small article, but there are economists that say as a nation, we are already paying a flat tax. According to an article in the New York Times, the different effects of payroll, state and local taxes the tax burden is probably the same or higher on the poor than the rich.

An article in Slate magazine, Tax Rates Are Already Flat, digests some of the material in the New York Times and states: "the Times has provided a more precise accounting that shows that those in the bottom quintile (people earning on average $7,946) pay almost exactly the same percentage of their income in taxes as people in the top quintile (people earning on average $116,666). The bottom fifth pays 18 percent, the top fifth pays 19 percent, and the three groups in between pay between 14 percent and 17 percent—which is to say, roughly the same. Obviously there's some individual variation, but on average Americans pay approximately 17 percent of their income in taxes, no matter what income they earn."

Many of the taxes you pay today are flat taxes. When you get a drivers license or library card, you pay the same as everybody else. Sales tax is a flat tax.

The idea of a flat tax for federal and state income tax appeals to many conservatives. Almost every year in congress bills are introduced that directly relate to the concept of a flat tax. Steve Forbes ran for president in 1996 on a platform of a 17% flat tax.

In talking about the flat tax it is important to note that there is difference between the flat tax in theory and in the real world. When assessing the validity of any proposed flat tax one must think about the context within which it is being applied, as well as how the author is defining the term "flat tax." With a flat tax, all taxpayers would pay the same rate.

Under a flat tax system for federal and state taxes, paperwork would be largely eliminated as taxes could be filled out on a single sheet of paper, but that there would also be a huge public outcry if the government don't have deductions for charitable contributions, mortgages interest, real estate taxes, etc.

Remember that once you allow anything like deductions for real estate or child support then it is not a flat tax anymore. for example, students that have to pay interest on their tuition loans get a tax credit. If that were removed, students would lose that incentive. But if you left it in, then it would no longer be a flat tax. This would affect many areas, including charities and the disabled.

The popular conception of a flat tax is that it would lower taxes for the wealthiest and raise taxes for the poorest - unless you lowered all taxes to the lowest level, but this would (of course) generate insufficent revenue for the state and federal government.

If the United States were to adopt a proportional tax system, that is to say a tax rate that averages the rates paid by the upper and lower classes, the tax rates for those with lower and higher incomes would have to change in proportion to generate the same income.

Our present tax system is by definition largely progressive, which means that how much you pay in taxes is based on how much you earn.

For example, the average federal tax rate for the bottom 50% of taxpayers in 2003 was 2.95%, while the average federal tax rate for the top 50% of taxpayers was 13.35%.

in a proportional tax system, the tax rate for the top 50% would go down, and the average federal tax rate for the bottom 50% of taxpayers would go up. If the tax rate for the lower percentage of taxpayers goes up, this would give them less available income to spend. The top 50% would have a larger percentage of their available income to spend.

The subject is actually far more complex than the scope of this small article, but there are economists that say as a nation, we are already paying a flat tax. According to an article in the New York Times, the different effects of payroll, state and local taxes the tax burden is probably the same or higher on the poor than the rich.

An article in Slate magazine, Tax Rates Are Already Flat, digests some of the material in the New York Times and states: "the Times has provided a more precise accounting that shows that those in the bottom quintile (people earning on average $7,946) pay almost exactly the same percentage of their income in taxes as people in the top quintile (people earning on average $116,666). The bottom fifth pays 18 percent, the top fifth pays 19 percent, and the three groups in between pay between 14 percent and 17 percent—which is to say, roughly the same. Obviously there's some individual variation, but on average Americans pay approximately 17 percent of their income in taxes, no matter what income they earn."

This would indicate that if you are an American citizen and all of the factors are considered, you are already paying a flat tax. The concept of a progressive tax in the United States is something of a myth.

23 Comments:

Wow! Great work in putting this info out there. I admit, at one time, I thought maybe the flat tax made sense. Of course, I got skewed info about it from someone who'd written a book in favor of the flat tax. After doing some research, though, it was clear that the flat tax was a loser.

Thank you for boiling it down like that! A lot of the flat tax proposals I've seen deal only with wage income, and of course the wealthiest don't make their money that way.

One of my favorite quotes was Pat Buchanan's dismissal of Steve Forbes' flat tax plan. Buchanan said it looked like something Forbes and his pals "cooked up at the yacht basin".

I still think people at the top should shoulder more of the burden and the resulting increased social services for all citizens would benefit everyone proportionally, or should, anyway.

That's what I'd do if I were in charge of the world.

Very well put, Dr. Zaius. I know plenty of flat-tax proponents who just can't grasp why it isn't fair. Now I can show them this post.

I am in that bottom 20% that pays 18% in taxes. I pay a tax on everyting I purchase including food. Yes, food. This has got to be one of the very most regressive of taxes.

I'm disabled and live on Social Security Disability. Since I was too ill to work for years before I filed for Disability, I only qualified for the very lowest rate possible. I live in a house that is paid for, but owe property taxes I can't afford. And the house needs repairs that I can't get a loan to make. Squeezed everywhere I look.

Thanks for this piece. It makes it very clear who wins and who loses with a flat tax.

Thank you Dr. Zaius. Very informative.

bubs said:

of course the wealthiest don't make their money that way

True that. They have historically made it dancing on someone elses back.

(saw them (him?)with Jesus and Mary Chain and later with Peter Murphy...good times)

utah savage,

I'm sorry for what you are having to deal with. It is teh shit, and inexcusible. America, greatest nation on earth? Ask the Danes.

For your pioneering work in Economics I've awarded you the coveted Marie Antoinette Award. No, really, not kidding. Come see me, I'll prove it.

You have done a brilliant job with this- thank you.

Why is it so difficult for the MSM to explain this to everyone?

(I'm not naive; I know why. I'm just asking a rhetorical)

A very good article with a clear explanation. The main problem I have with taxes is in the way the monies received are disbursed. People in the statistically larger lower classes are forced to pay their share but receive the lowest benefits.

Yeah, the concept of a progressive tax has become the stuff of myth and legends... kind of like the concept of an infrastructure that isn't crumbling under us or an government that isn't outsourced to incompetent contractors.

When I was younger I remember my father being a proponent of a flat tax, back when Forbes was making a serious bid at the Presidency (well... I'm sure he thought he was serious). Looking back... I'm glad I inherited my brains from my mother.

I remember back in '97 when I was working on Cape Cod Kerry released his federal tax records and I was shocked to see that altho his income from the Senate and other income was over ten times what I made, he paid less taxes than I did on his income. And who knows what his wife made. The rich pay less in taxes because they can afford to pay someone to see to it that their taxes are as low as possible. This is all part of shifting the tax burden from those that can afford it to those that can't.

S, Dr Z., are you award averse? This is such a lovely award and very appropriate for this piece. It's the coveted Marie Antoinette award. Really. Not kidding.

Dr. Z, thanks for this excellent post. I have only one concern ... What is the tax on a piece of chocolate cake?

BAC

Thanks for the breakdown, Dr. Z. May have to print this out and keep copies in my wallet for when I meet idiots who think they know everything (i.e., repuglicans).

You're one smart ape.

DCup: A flat tax only helps the wealthy, in my opinion. But we are already paying a flat tax anyway!

Bubs: "cooked up at the yacht basin" Ha! Pat Buchanan is a tool, but that's pretty good!

Comrade Kevin: **sigh** Me too.

Some Guy: Usually the people that can't grasp why a flat tax isn't fair are the ones who stand to benefit from it!

Utah Savage: Ack! I'm getting squeezed from all sides, also!

Spirula: :o)

Utah Savage: Thank you, Utah Savage!

FranIAm: :o)

Übermilf: **sigh** The media is so annoying.

Randal Graves: Ha! That's the ticket!

Susan: Maybe Obama will fix everything! :o)

chaos4700: Your mother sounds like a very intelligent woman.

Kulkuri: It's a scam! I agree.

Utah Savage: Ack! I will get to the award, I promise!

BAC: There is no tax on chocolate cake! It is heaven's gift to those of us on earth.

Dguzman: Thank you, Dguzman. :o)

It’s going to be end of mine day, however before end I am reading this wonderful article to increase my experience. 경마사이트

As a Newbie, I am permanently exploring online for articles that can help me. Thank you 카지노사이트

Nice one! Thank you for sharing this post. Your blog posts are more interesting and impressive.

토토사이트

It’s impressive that you are getting thoughts from this piece of writing as well as from our discussion made at this time. 바카라사이트인포

It's perfect time to make a few plans for the future and it is time to be happy. I've learn this submit and if I may just I desire to recommend you some attention-grabbing things or advice. Maybe you could write subsequent articles referring to this article. I want to read even more issues approximately it!

Also visit my web page : 고스톱

I really liked your article post. Really looking forward to read more. Great.

Say, you got a nice article. Really thank you! Fantastic.

성인웹툰

This comment has been removed by the author.

Post a Comment

<< Home